We also reference unique research from different reputable publishers the place applicable. Performance information may have modified because the time of publication. These embody white papers, government data, authentic reporting, and interviews with trade specialists. Citigroup (C -5.1%) and Bank of America (BAC -3.9%) are falling essentially the most of U.S.-based megabanks in midafternoon buying and selling on Thursday within the wake of Russia’s invasion of Ukraine. You can learn more in regards to the requirements we follow in producing correct, unbiased content material in oureditorial coverage.

Citigroup (C -5.1%) and Bank of America (BAC -3.9%) are falling essentially the most of U.S.-based megabanks in midafternoon buying and selling on Thursday within the wake of Russia’s invasion of Ukraine. You can learn more in regards to the requirements we follow in producing correct, unbiased content material in oureditorial coverage.

Your financial state of affairs is unique and the services we evaluation is most likely not proper in your circumstances. You can also want to consult with a monetary advisor to review investment options or your overall funding strategy.

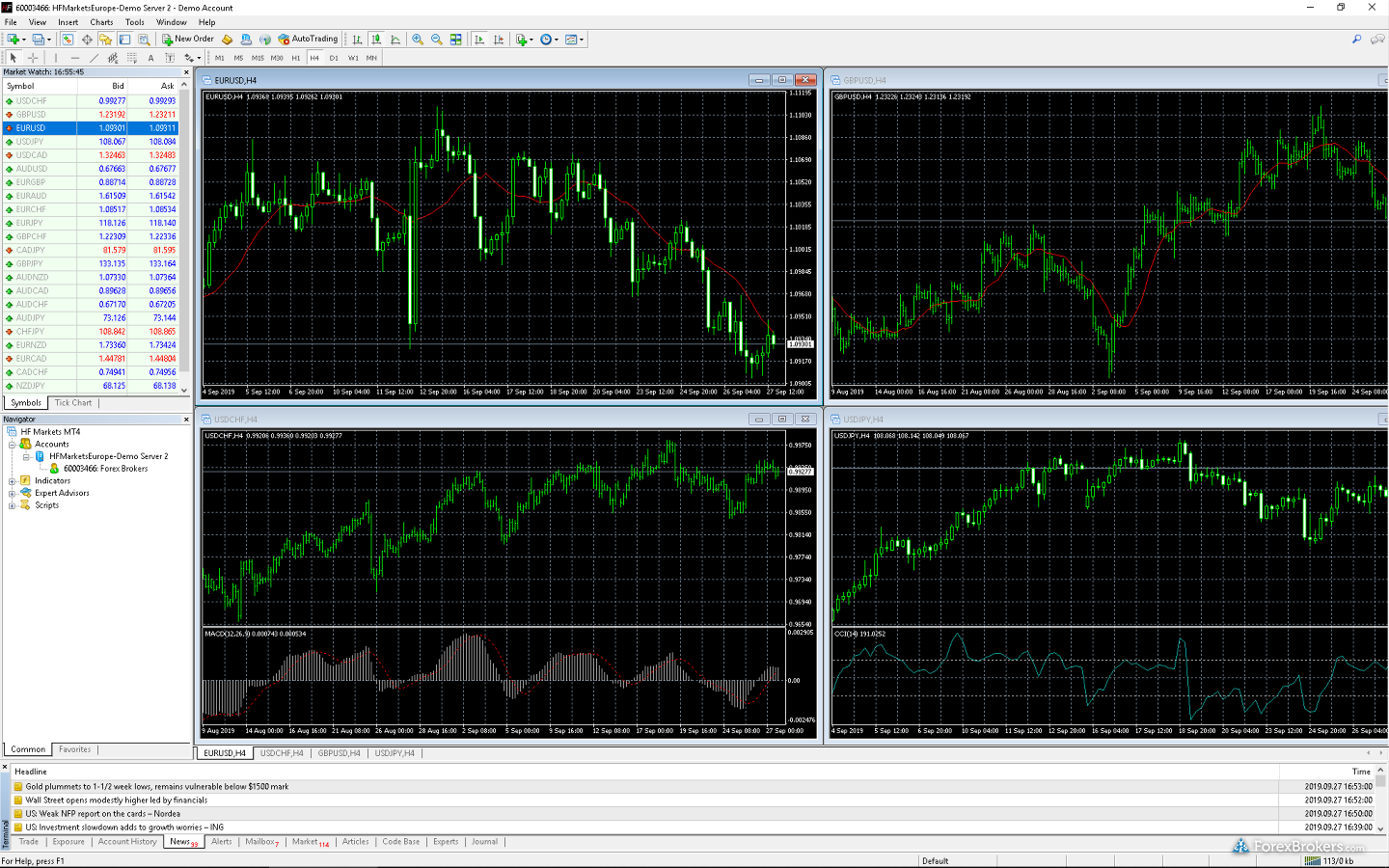

To see all change delays and terms of use, please see disclaimer. We don’t provide financial recommendation, advisory or brokerage providers, nor will we recommend or advise people or to purchase or sell particular shares or securities. Investors are flocking to government bonds, Best MT4 Indicators for Forex Trading with the 10-year Treasury yield falling 6 foundation points to 1.93% after having touched just… No matter the way you go about investing in large-caps, it’s essential to research individual shares or funds earlier than including them to your portfolio. The Google segment consists of its main Internet products corresponding to adverts, Android, Chrome, hardware, Google Cloud, Google Maps, Google Play, Search, and YouTube.

This Financial Times–based list is up to date as of December 2006. The firms on this index had a median market cap of $11 billion as of September 2021. This Financial Times–based record is up to date as of December 31, 2007. Indicated changes in market value are relative to the earlier quarter. C’s revenue has moved down $2,289,000,000 over the prior 70 months.The table under shows C’s development in key monetary areas .

The Russell Midcap Index tracks approximately 800 companies and Best MT4 Indicators for Forex Trading is a subset of the Russell one thousand Index. Before becoming a member of Forbes Advisor, John was a senior author at Acorns and editor at market research group Corporate Insight. FBC, ELVT, and GDOT are the shares whose asset turnover ratios are most correlated with C. Large-cap corporations are sometimes corporations with a market value of $10 billion or more. They are sometimes dominant players within established industries, and their model names could also be acquainted to a nationwide consumer audience. His work has appeared in CNBC + Acorns’s Grow, MarketWatch and The Financial Diet.

On the opposite hand, small-cap shares could supply important progress potential to long-term investors who can tolerate volatile stock price swings in the short term. is a holding firm, which engages in the enterprise of acquisition and operation of different companies. John Schmidt is the Assistant Assigning Editor for investing and retirement. Government bonds on the time were offering unappealingly low returns, and Best MT4 Indicators for Forex Trading the shaky cryptocurrency market was in a downward pattern. As a result, investments in large-cap stocks could also be considered more conservative than investments in small-cap or mid-cap shares, potentially posing less threat in exchange for much less aggressive progress potential. Stocks have been the only game value taking half in at the time, so that’s what investors turned to. Market capitalization is probably one of the primary ways to value publicly traded firms.

In fact, in 2018, only 14% of all Americans instantly owned shares in a publicly-traded company, based on financial writer Ben Le Fort. Investors also had little choice for opportunities to place their cash into. If a company issues a dividend—thus increasing the number of shares held—its price often drops. This is the record of the biggest companies within the USA by market capitalization. Although the variety of outstanding shares and the stock price change, an organization’s market cap stays constant. With its outsized influence, the US stock exchange drives the economic system of the entire world, for higher and worse.

For example, in a 2-for-1 break up, the share price will be halved. Stocks usually have a safe return as the companies have an excellent market presence. True to predictions, many companies suffered severe losses, buyer spending slowed down, and unemployment went up. Only the top american corporations are proven on this listing and corporations that aren’t publicly traded on a stock change are excluded.

The stock markets dropped off sharply in March, in anticipation of a looming shutdown and its expected effects on the US financial system. Investors who don’t wish to take as a lot risk may wish to root their portfolio in less-volatile large- and mega-caps, with a decrease allocation of small- and mid-caps. Entrepreneurs are turning to social media to finance new companies.

The median market cap of companies on this benchmark was around $5.5 billion as of September 2021. This is a ratio arrived at by dividing the current market price of a stock by its latest earnings per share. There’s room for each in the world and there’s room for each in a portfolio,” Shyu says.

This is a ratio arrived at by dividing the current market price of a stock by its latest earnings per share. There’s room for each in the world and there’s room for each in a portfolio,” Shyu says.

All different things being equal, greater the dividend yield of the stock, the better it’s for investors. “Do you wish to have Joe’s Burgers around the corner or do you need to have McDonald’s? It has backtesting, great charts, stock screening, and an energetic community of over 3 million individuals sharing ideas, plus a free plan available globally. My favorite software Best MT4 Indicators for Forex Trading trading is TradingView because it does every thing well. For extra perception on analysts targets of C, see our C price goal page.

My favorite stock-picking service is Motley Fool Stock Advisor, which has a proven track report of beating the market with wonderful stock research stories. Large-cap corporations typically have a reputation for producing high quality goods and providers, a history of consistent dividend funds, and steady development. It operates in two segments, Global Consumer Banking and Institutional Clients Group.